A Canadian Mining Story Unfolding in Real Time: The Hunt for Critical Metals

The Global Race for Critical Metals is Accelerating. A Potential Once-in-a-Decade Story is Unfolding in Real Time.

I've been exceptionally fortunate in the realm of natural resource exploration investments, bearing witness to a few extraordinary success stories unfolding right before my eyes. Companies like K92 and Great Bear, evolving from mere concepts with 5-cent shares in a venture shell to industry behemoths within just a couple of years. The exhilaration of watching the ascent from 5 cents to 5 dollars is truly indescribable - a thrill reserved for elite speculators with the extraordinary discipline required to endure such substantial percentage gains. 99% of players unload their 5-cent stock by the time it reaches 50 cents - only to feel the sting of “shoulda-woulda” for decades to come.

Speculating on these resource start-ups has been my primary source of entertainment (and heartache) for the past two decades, and I genuinely love it. However, it's essential to keep in mind that they rank about 11 out of 10 on the risk scale. Despite the high level of risk, the risk/reward ratio is hard to ignore when all the boxes are checked.

I believe that one of those potentially face-melting, once-in-a-decade rippers might be unfolding here in Canada again, as we speak.

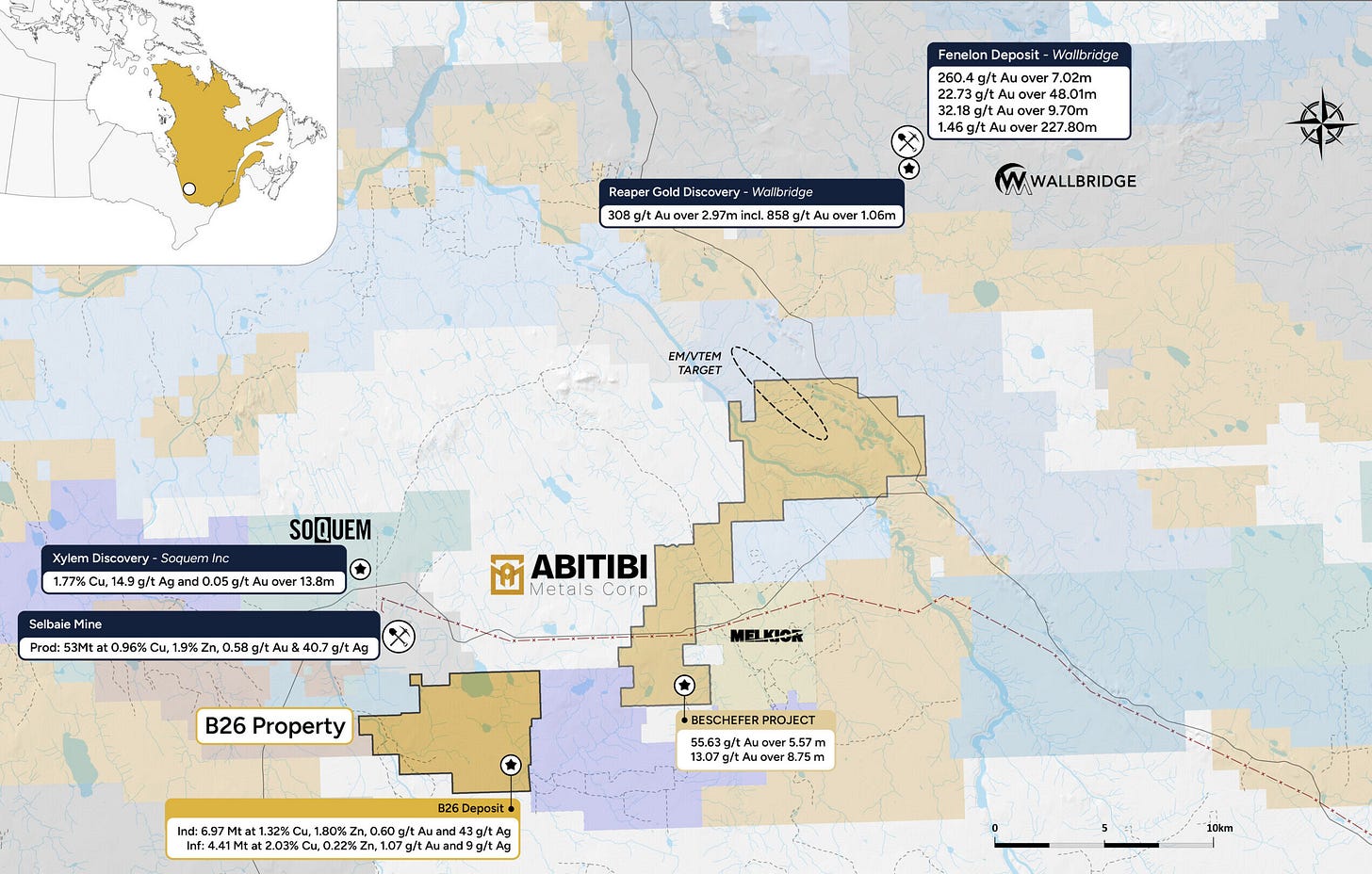

The company is called Abitibi Metals and the project is the B26 copper deposit.

Three critical components are absolutely required on these highly-speculative, lottery-ticket-style mineral exploration Co’s:

Great people

Incredible project(s)

Ungodly amounts of capital at each juncture

Abitibi Metals checks all three boxes, making it a compelling player in the speculative landscape of junior mineral exploration companies for 2024 and beyond.

At the helm of Abitibi Metals (AMQ) is Jon Deluce, a noteworthy mining executive from the esteemed Deluce family in Ontario. Known for their significant contributions to the mining industry and as the proprietors of Porter Airlines, the Deluce family brings a wealth of experience and influence to AMQ.

Abitibi Metals is tightly held, with Jon and his family commanding the majority of the approximately 90 million outstanding shares (fully diluted). The Deluce family's renowned success in mining and beyond makes their alignment with shareholders a powerful testament to the project's quality and potential.

The B26 deposit, now under the adept stewardship of Abitibi embodies everything and more one could hope for in a junior public company - the perfect blend of substance and excitement. Interestingly, the B26 deposit was originally under the ownership of the Quebec government before being granted to Jon and AMQ through an option. Remarkably, it has never been part of a public company, leaving real price discovery still very much to be determined.

Strategically positioned just 5km south of the Selbaie mine, Abitibi Metals' B26 property is not only conveniently road-accessible but also benefits from power lines directly overhead. The historical significance of the late 90’s discovery hole, intercepting 1.87 g/t Au and 2.89% Cu over 11.3 meters, underscores the promising nature of this site.

Adding to the allure, AMQ holds a 7-year option to secure 80% ownership of this deposit, accompanied by a 2018 Resource Estimate Indicating 6.97 million tonnes at 2.94% Cu Eq and another 4.41 million tonnes at 2.97% Cu Eq in the Inferred category.

Hats off to Jon for skillfully negotiating not only the acquisition of the property but also securing highly favourable terms. Such negotiation skills might see him fulfill the entire option commitment next year, which would be a remarkable feat. And who knows; maybe the company will even end up with the final 20% of the deposit after they’ve earned the trust of the optionor.

What sets this opportunity apart in my view is that it offers both the 'steak' and the 'sizzle'. That magical once-in-a-decade balance of the two.

In exploration, acquiring a resource in the ground is a rarity, and often, resources come with hefty price tags and without sufficient blue-sky potential (sizzle) beyond what's indicated or inferred.

(Note: The company's other five projects will be left out for now, as they are not perceived as particularly value-add as it relates to B26, nor are they deemed distractions or deterrents.)

With the key man and his expert team at the helm, and a compelling project in the midst of a copper shortage, Abitibi Metals finds itself in a prime position, benefitting from a critical commodity tailwind.

As for the third key ingredient, capital, rest assured, it won't be a concern here. Jon and his family's remarkable success is matched by their extensive connections to financiers worldwide, ensuring a robust financial backing for the venture.

The success of a junior public company usually hinges on the CEO's prowess in capital raising. Case in point: after Abitibi Metals (AMQ) secured the option for the B26 deposit on November 16th, the stock witnessed a remarkable surge in value on substantial trading volume.

Closing at $0.135 on November 15th, 2023, the stock leaped to $0.255 on the 16th, marking an impressive day-one re-rating of +88%, on the news and in anticipation of a financing.

With just over 60 million shares outstanding at the time, the market cap stood at approximately $8.1 million before the option was granted - an indication of the substantial impact a strategic move like this can immediately have on the company's valuation.

That’s called value creation, and it’s beautiful to see:

Naturally, it took the market five or so sessions to fully recognize the potential value in the ground, leading to a sustained upward trajectory in the stock. By the end of November, it had surged to a high of 55 cents, capturing the attention of numerous onlookers - all pondering the same question: financing. With heightened interest, the spotlight shifted to the details of the financing, leaving many to wonder about the key players involved and what levels they’re coming in at.

The significance of junior company CEOs controlling their cost of capital cannot be overstated. Abitibi Metals has demonstrated exceptional acumen in this regard, skillfully avoiding unnecessary dilution, especially during the early, crucial stages.

In a move that surprised many, on December 4th of last year, Abitibi announced a strategic $3 million, 30-cent private placement. Notably, the financing involved two significant names and, to the market's delight, did not offer a warrant - an indication of the company's shrewd approach to capital management.

This move is particularly noteworthy as it defies the norm in the realm of private placements, where warrants are typically a required deal sweetener. Warrants serve as the incentive for investors to participate, differentiating the offering from buying shares in the open market. Their omission is a strategic rarity that contributes to the company's ability to avoid additional dilution and sidestep the common phenomenon of 'warrant overhang.' This situation often occurs when stock prices struggle to surpass the warrant strike price until all warrants are either exercised or expired.

Further emphasizing the significance of no warrants, it's worth noting that once the 4-month lock-up period expires on the financing, shares usually hit the market if a warrant was included. Investors, having received a 1-for-1 warrant coverage, essentially hold a two-year call option on the stock. This structure provides them the flexibility to avoid tying up capital in the stock when they already have warrant coverage.

Financings with warrants are notably more susceptible to selling pressure in months 4, 5, and 6, as investors, lacking the additional incentive provided by warrants, may smash that proverbial bid as soon as they’re unlocked and up on the trade.

In a strategic move, Jon opted not to include warrants and kept commissions to a bare minimum in the December 4th private placement at 30 cents. Notably, industry titans Frank Giustra and Greg Chamandy joined the investor roster, prompting an upsizing of the private placement to $4.37 million to meet the overwhelming demand once news of their participation spread.

As if the success of the recent private placement wasn't commendable enough for a relatively unknown junior in a challenging market, Jon Deluce continued to make waves. Just a week later, he secured a remarkable $10 million flow-through financing at $0.70 per share - a substantial premium (even at follow-through standards) to the recently closed private placement at $0.30 and to the market price.

With almost $15 million in cash secured, anticipation builds for an exciting 30,000 meter drill campaign in 2024. Backed by a solid, proven, and committed team, Abitibi Metals not only boasts a very real project but also has garnered the involvement of three or more families, collectively valued in the billions. The stage is set for a compelling journey ahead.

With a tightly held, warrant-free structure, significant insider ownership, and a share count below 100 million, the Abitibi Metals narrative is precisely the kind that captivates astute retail investors. The pieces are falling into place, and the momentum is growing.

The enthusiasm of retail investors serves as the catalyst for attracting institutional flow of capital - a crucial ingredient for blood-thirsty investment bankers to enter the scene, offering coverage and capital in exchange for fees and fancy dinners. As I said: check, check and check.

As a fundamental investor at heart, the details I've just shared present a robust picture, offering a 'meat on the bone' perspective - one that aligns with traditional due diligence principles.

Now, let's jump into the technicals:

While charts can be notoriously unreliable for volatile penny stocks, the chart below paints as close to a perfect picture as one could hope for:

This basic chart of AMQ shows a clean, laddered rise on the B26 news, characterized by higher highs and higher lows in a remarkably consistent fashion, followed by a textbook price consolidation around the 45-cent level for about a month after it became way too overbought, peaking out around 66 cents:

the stock broke out of the teens following the B26 news

surged past the 30-cent mark with the announcement of the financing

breaks through the .40s on news of notable participants in the 30-cent financing

a subsequent leap into the .50s on news of a $10 million financing at $0.70

the stock perfectly consolidated around .45, and built a new base

Equally as important to point out; buying pressure has remained robust since the B26 news, evident in the phenomenal bid/ask ratio.

This matters because each upward movement in the price is a result of genuine, fundamental, and material positive advancements for the company - not mere market speculation. This stands in stark contrast to the often transient gains driven by less substantial factors, commonly seen in stocks that experience climbs followed by steep falls once the initial enthusiasm wanes and attention shifts to new, more enticing tickers.

In this case, the presence of hype is undeniable, but the increases in market cap are not a result of manipulation or payment by large promoters. The real catalysts for these increases are yet to come in 2024. This is precisely why I share this story today. The rise is genuine, feels sustainable, and has since formed a solid foundation. It's a phenomenal starting point for quality market awareness campaigns, driven by tangible developments and established market cap support levels. AKA: the stock is a promoters dream and it doesn’t even have it’s OTCQB ticker live yet.

Last note on the technical side of things, house reports provide even more compelling data. A quick report from Nov 16th, the date of the acquisition, to the last trade reveals additional impossible-to-ignore insights:

28+ houses participated so far

22 of which are net-buyers

over 93 million shares traded since then

keep in mind only about 35~ million shares in the tradable float as of this writing

algos are all over it because of the volume, so it’s not a liquidity trap like everything else

Institutions are already making a market, prior to commercial partnerships

So, the tradable float has effectively turned over twice in only three months, and this is before promotional activities have really begun? That's truly impressive. The positive reaction from the street is a noteworthy factor in the overall assessment of this deal.

Technicals are very much on the companies side here.

But wait, it gets even better. Since the news broke on the 16th, I've personally been on the bid for shares of this company. I managed to secure a very small amount of the private placement at 30 cents, and then acquired additional shares in the market at 0.45 and 0.55. However, the market shares I own, I had to buy off the offer. As God is my witness, I would place my bid on top, and it would sit there all morning with no one hitting it (Until Jan 2 of this year when things calmed down). This was highly unusual in 2023 on the CSE or Venture. I think this stock wants to go higher and just might if the good news continues.

So, let me be clear - I own very, very little here, and I'm not sharing this information because the company told me to or incentivized me in any way. Quite the contrary. In fact, I'm going against my own interest because I'm a buyer of this stock, not a seller. Nor am I commercially involved with the company. I'm not a hype man trying to create buzz while sitting on the offer, using others as liquidity. I'm writing about this stock because I have a passion for uncovering unicorns and scrutinizing their potential. In this case, I can't detect any red flags, and that makes me want to own it. I'm hopeful for big catalysts this year, both in terms of results and potential M&A with larger operators.

In my twenty-years of observing junior stocks trade, I've never once witnessed a stock trade with such a bias towards an offer purchase initiating the trade, as opposed to bid hitting initiating the trade (bid/ask ratio). The consistency of this pattern astonished me and it continued in this manner right up till the end of last year.

In fact, AMQ was in the top 1 percent of all junior stocks in Canada, both in terms of direction and strength up until the pull-back.

So now what? Can you even buy a junior after it’s gone from a quiet 5-cent’er to a busy 50-cent’er?

Not usually advisable, no. Chasing hype is never a good idea.

But… and the reason for this article… is that I personally am of the opinion that 50-cents is the new 5-cents here and the trading pattern confirms my thesis. I believe that we are just getting started at 50 cents and I am putting my money where my mouth is:

Only about $100k in the market so far for me this year (avg. cost around $0.48 per share), and I will continue buying in small tranches until I’ve deployed about 6-7 times that amount. I will then hold until my above thesis breaks down, or the stock gets bought out. So as you can see, I am personally starting my own position here at today’s levels. So, no, I don’t think this train has left the station yet. No stop loss in place for me, as I don’t believe in them on pure spec positions like this. I personally welcome lower prices because with a long-term-outlook it simply provides opportunities to average down and lower my adjusted cost base. Assuming the share count remains healthy and doesn’t blow up with bad management decisions.

I had an inkling that something amazing was in the pipeline months before it was officially announced. However, I didn't buy before the news. It's simply not in my nature to take advantage of situations like that.

(I know, I know, everyone in Vancouver does - I’m not one of them)

Unlike lifestyle companies ran by charlatans on Howe St., this is not a venture where half the funds raised go to lavish dinners with the boys, hoping for just enough positive results to perpetuate a cycle of cheap, high commission, private placements until a rollback becomes inevitable. Instead, Abitibi Metals represents an established family's commitment to discovering a mine and unlocking immense value over time.

It's a legacy play, and who doesn’t love those?

I refrained from front-running this opportunity because I recognized it as something truly special in the works. I had the privilege of sitting down with Jon during the summer, and while I got the idea that something significant was clearly in the works, he was professional enough to keep it under wraps until it was finally done and announced. And I deeply respect that. I would never jeopardize him or the relationship, and I could tell that Jon was cut from the same cloth.

Also, Alex Deluce, Jon's brother, is not just someone I admire but also consider a very dear friend. His contagious excitement adds an extra layer of enthusiasm for me. Seeing this venture evolve, driven by the hard work of two good brothers, is more than an investment opportunity; it's fun, gritty, and distinctly Canadian. If you're a speculator or a copper bull, the upside potential is hard to ignore.

When can you ever say that about a CSE/venture exploration stock?

Mineral exploration is absolutely beautiful when executed properly.

Unfortunately, only 1 out of 500+ make a real go at it like these guys are.

As for action items, my advice is to watch it closely. Take the time to get to know it well, and perhaps consider scaling in only if you see and understand the risk and the opportunity. I might be a bit ahead of you in this journey, but remember, the difference between $0.25, $0.55, and $0.75 means little when the potential is far greater. It's crucial to recognize that trading and investing are not binary activities. Entering and exiting a position should be done gradually, very patiently, in tranches, over time. If you're not following this approach, it might be a key reason for underperformance. I delve into this concept here.

Lastly, on the bear side of things, it's essential to keep in mind that we have two significant 4-month unlocks on the horizon, offering potential buying opportunities lower. These unlocks typically introduce a healthy dip in price as earlier investors gain the ability to sell their holdings (again, it’s TBD how this non-warrant financing will be sold off). One unlock is set for the middle of April 2024, involving the 14.5 million shares sold at 30 cents in Nov/Dec. The second occurs at the very end of April 2024, encompassing the 14.4 million shares from the flow-through financing that closed on Dec 29th, 2023. It's advisable to mark the end of April/early May on the calendar and anticipate increased volume and volatility in the weeks preceding and following.

(No, I am not an advisor, and yes, you need to do your own due diligence and only play these risky, speculative stocks within your limits).

Now, I can almost hear the skepticism. I'm not outright claiming that this is destined higher. Is it within the realm of possibility? Yes. Do I entertain the thought that it just might? Let's put it this way: If they continue to judiciously use their stock as currency, consistently achieve milestones, get lucky with positive drill results, all while keeping the float reasonably small, then the speculators dream of a 10-bagger from here in the next couple years doesn't seem that far-fetched to me. This is why I’m putting it on your watch list and continuing to buy myself.

-Brayden

Company web-site Here.

Tickers: CSE: AMQ - OTC: AMQFF - FSE: FW0

Recent interview with Jon Here.

Also, a special thank you to the one and only Tommy H. (Here and Here) for his part in this and for always being at the center of everything cool.

Disclaimer: I am not in any way affiliated with, nor have I been compensated by Abitibi or anyone close to it in any way. This is NOT sponsored content. I’m a regular old retail shareholder with good access, taste, timing and a keen eye for bullshit and for unicorns.

Very thorough - thanks Brayden!

Great write up! Not sure about tightly held though as there is constant dumping by these strategic investors onto the bid, and there's another unlock coming in August.